TOKENOMICS

Total Token Supply

- Token Name: HYRA

- Symbol: HYRA

- Layer 3 Blockchain Type: Hyra Network

- Token Type: Utility, Governance

- Total Supply: 50,000,000,000 HYRA

- Initial Circulating Supply: Initial Circulating Supply: 5% (2,500,000,000 HYRA), pre-minted according to the initial issuance plan.

Objectives

- Link HYRA’s value to real business performance: HYRA’s value depends on the performance of Nodes services and AI services, ensuring benefits for all ecosystem participants.

- Enhance sustainability and transparency in ecosystem development: Mint and Burn activities are recorded and verified on Layer 3 blockchain (HYRA Network), ensuring absolute transparency for the community.

- Ensure HYRA becomes the centerpiece of the ecosystem’s operations: HYRA is designed to play a central role in all transactions and interactions within the HYRA Network, from accessing services to participating in governance.

Key Features

- Inflation Rate: None.

- Scalability: Fixed total supply ensures token scarcity, enhancing long-term value.

- Stability: The Mint and Burn mechanism balances supply and demand, supporting sustainable growth.

HYRA Network’s tokenomics serves as both an economic mechanism and a key driver for the Layer 3 blockchain ecosystem, focusing on AI technology and Web3 services.

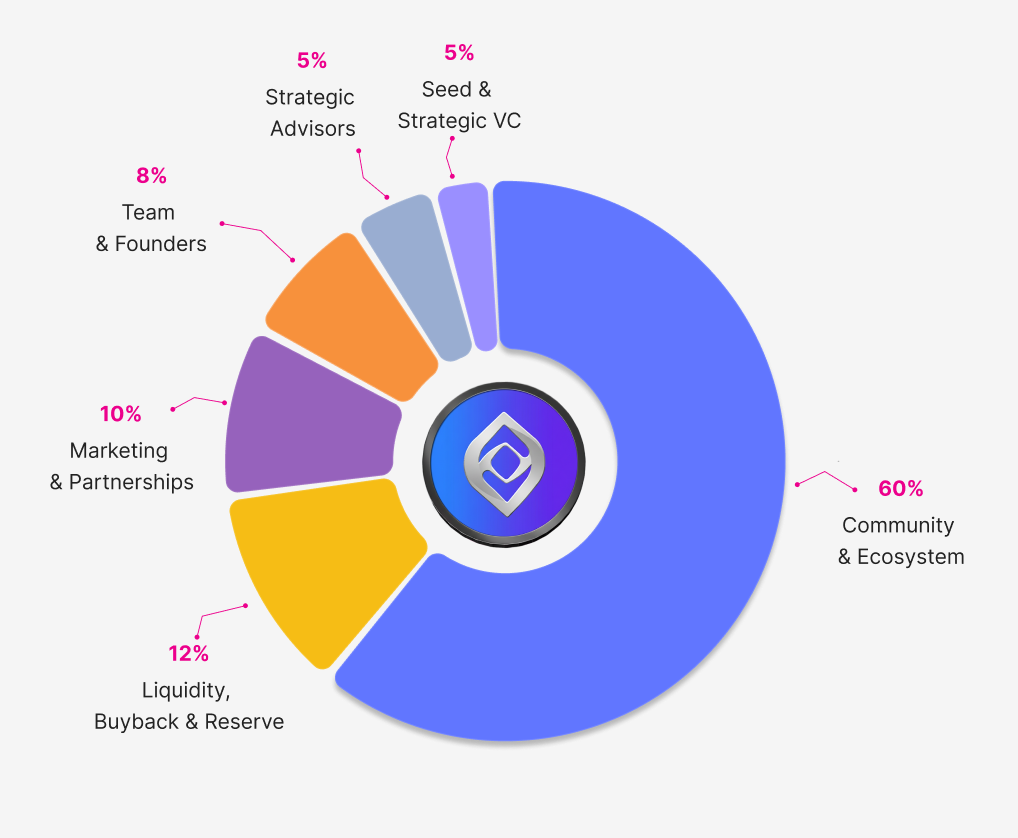

Token Allocation

- Community & Ecosystem (60% - 30,000,000,000 HYRA): Staking rewards, DAO support, community development, infrastructure investment, and computational power contributions.

- Liquidity, Buyback & Reserve (12% - 6,000,000,000 HYRA): Provides liquidity, stabilizes token price, supports buybacks, and addresses strategic contingencies.

- Marketing & Partnerships (10% - 5,000,000,000 HYRA): Strategic collaborations and global marketing campaigns to attract new users.

- Team & Founders (8% - 4,000,000,000 HYRA): Ensures incentives for founders and strategic staff, tied to project development KPIs.

- Partners & Advisors (5% - 2,500,000,000 HYRA): Strategic partner support (70%) and advisory expertise (30%), with flexible unlocking based on collaboration agreements.

- Seed/VC Investors (5% - 2,500,000,000 HYRA): Provides seed funding, locked for 6 months, and unlocked at 10% per month over the next 10 months.

Token Vesting Policy

| Category | Vesting Details |

|---|---|

| Community & Ecosystem | - No lock-up - Tokens minted and circulated based on actual revenue |

| Liquidity, Buyback & Reserve | - 50% unlocked immediately at TGE - 50% unlocks at 10% per year over 5 years |

| Marketing & Partnerships | - First 3 Years: 20% at TGE + 10% quarterly - Next 5 Years: 50% unlocks at 10% per year |

| Team & Founders | - Locked for 24 months - Then unlocks 10% quarterly over 10 quarters (2.5 years) |

| Partners & Advisors | - Strategic Partners (70%): Unlock based on milestones or achievements - Advisors (30%): Unlock based on goals |

| Seed/VC Investors | - Locked for first 6 months (Genesis) - Unlocks 10% monthly from month 7 to month 16 |

Details of token unlocking timeline and mechanism:

- Community & Ecosystem (60%)

- Allocation: 30,000,000,000 HYRA

- Vesting Policy: No lock-up; tokens are minted and circulated based on actual revenue.

- Liquidity, Buyback & Reserve (12%)

- Allocation: 6,000,000,000 HYRA

- Vesting Policy:

- 50% (3,000,000,000 HYRA) unlocked initially for liquidity on DEXs and CEXs.

- 50% (3,000,000,000 HYRA) unlocked over 5 years:

- 10% annually (600,000,000 HYRA per year).

- Marketing & Partnerships (10%)

- Allocation: 5,000,000,000 HYRA

- Vesting Policy:

- 50% (2,500,000,000 HYRA) for major campaigns in the first 3 years:

- 20% unlocked initially.

- 10% unlocked quarterly over the next 2 years.

- 50% (2,500,000,000 HYRA) unlocked gradually for new development phases:

- 10% unlocked annually over the next 5 years.

- 50% (2,500,000,000 HYRA) for major campaigns in the first 3 years:

- Team & Founders (8%)

- Allocation: 4,000,000,000 HYRA

- Vesting Policy:

- Locked for the first 24 months (2 years).

- Then, 10% unlocked quarterly (400,000,000 HYRA per quarter) over 10 quarters (2.5 years).

- Partners & Advisors (5%)

- Allocation: 2,500,000,000 HYRA

- Vesting Policy:

- Flexible unlocking based on collaboration agreements:

- 70% (1,750,000,000 HYRA) for strategic partners, unlocked based on milestones or contribution achievements.

- 30% (750,000,000 HYRA) for advisors, unlocked upon meeting specific advisory objectives.

- Flexible unlocking based on collaboration agreements:

- Seed/VC Investors (5%)

- Allocation: 2,500,000,000 HYRA

- Vesting Policy:

- Locked for the first 6 months from Genesis.

- 10% unlocked monthly starting from the 7th month, over the next 10 months.

This tokenomics structure ensures a balanced distribution to support the ecosystem's development while maintaining sustainability and value growth over the long term.

Token Minting Mechanism

Minting Rules:

HYRA tokens are minted based on the ecosystem's GDP and performance:

- Revenue from AI decentralized services (HYRA AI): Includes training, inference, and data labeling.

- Revenue from Nodes sales: Qualcomm Nodes, Nvidia Nodes, etc.

- Revenue from AI infrastructure leasing: Business services.

- User staking profits: Transaction fees and network rewards.

- Other revenue streams: NFT marketplace, blockchain transaction fees (gas fees), and Web3 applications.

Token Circulation:

The circulating supply is determined by GDP and ecosystem activities. Unused tokens are burned weekly or monthly.

Mint Token (M)

Mint Formula: M = T × R

- M: Number of tokens minted per year.

- T: Total planned token supply (50,000,000,000).

- R: Annual minting rate, changes according to each phase.

Minting Rates by Phase:

- Phase 1 (Year 1–10): R = 5% = 0.05 per year.

- Phase 2 (Year 11–15): R = 3% = 0.03 per year.

- Phase 3 (Year 16–25): R = 1.5% = 0.015 per year.

Phase 1: Year 1 - Year 10

Minting rate: 5% per year.

Max mint per year: 2,500,000,000 HYRA.

Total mint in 10 years: 25,000,000,000 HYRA.

- Year 1: Mint 2,500,000,000 HYRA.

- Year 2: Mint 2,500,000,000 HYRA.

- Year 3: Mint 2,500,000,000 HYRA.

- Year 4: Mint 2,500,000,000 HYRA.

- Year 5: Mint 2,500,000,000 HYRA.

- Year 6: Mint 2,500,000,000 HYRA.

- Year 7: Mint 2,500,000,000 HYRA.

- Year 8: Mint 2,500,000,000 HYRA.

- Year 9: Mint 2,500,000,000 HYRA.

- Year 10: Mint 2,500,000,000 HYRA.

Phase 2: Year 11 - Year 15

Minting rate: 3% per year.

Max mint per year: 1,500,000,000 HYRA.

Total mint in 5 years: 7,500,000,000 HYRA.

- Year 11: Mint 1,500,000,000 HYRA.

- Year 12: Mint 1,500,000,000 HYRA.

- Year 13: Mint 1,500,000,000 HYRA.

- Year 14: Mint 1,500,000,000 HYRA.

- Year 15: Mint 1,500,000,000 HYRA.

Phase 3: Year 16 - Year 25

Minting rate: 1.5% per year.

Max mint per year: 750,000,000 HYRA.

Total mint in 10 years: 7,500,000,000 HYRA.

- Year 16: Mint 750,000,000 HYRA.

- Year 17: Mint 750,000,000 HYRA.

- Year 18: Mint 750,000,000 HYRA.

- Year 19: Mint 750,000,000 HYRA.

- Year 20: Mint 750,000,000 HYRA.

- Year 21: Mint 750,000,000 HYRA.

- Year 22: Mint 750,000,000 HYRA.

- Year 23: Mint 750,000,000 HYRA.

- Year 24: Mint 750,000,000 HYRA.

- Year 25: Mint 750,000,000 HYRA.

Total Minting in 25 Years

A total of 40,000,000,000 HYRA will be minted over 25 years.

The remaining 10,000,000,000 HYRA will not be minted.

Unspent minted tokens each year will be burned monthly to reduce circulating supply and support token value.

Circulating Token (C)

Circulating Formula: C = GDP Pool / Target Token Price

- C: Number of circulating tokens.

- GDP Pool: Total value from ecosystem revenue: GDP Pool = 0.3 × Revenue from Nodes + 0.8 × Revenue from Services.

- Target Token Price: Expected value of the token (e.g., 1 USD/token).

Example for 2025:

- Revenue from Nodes = 6,500,000 USD.

- Revenue from AI Services = 7,200,000 USD.

Calculate GDP Pool:

GDP Pool = 0.3 × 6,500,000 + 0.8 × 7,200,000 = 7,710,000 USD.

Calculate Circulating Token:

C = GDP Pool / Target Token Price = 7,710,000 / 1 = 7,710,000 HYRA.

Token Burn (B)

Burn Formula: B = M - C

- B: Number of tokens to be burned.

- M: Tokens minted in the year (based on phase).

- C: Circulating tokens determined from the GDP Pool.

Example for 2025:

- M = 1,500,000,000 HYRA (Year 2025 from Phase 3).

- C = 7,710,000 HYRA.

Calculate Token Burn:

B = M - C = 1,500,000,000 - 7,710,000 = 1,492,290,000 HYRA.

Real-World Applications of Token (Token Utility)

- Transaction Fees: Use HYRA to pay transaction fees on the platform.

- Staking: Users stake HYRA to earn rewards and contribute to network security.

- Governance: HYRA holders have the right to vote on important ecosystem proposals.

- User Rewards: Rewarding users who contribute computational resources and participate in the ecosystem.

- DAO Governance: HYRA holders have the right to vote on policies and projects.

- Infrastructure Expansion: Invest in nodes (Qualcomm Node, Nvidia Node) to support infrastructure.

- Exclusive Privileges: Burn HYRA to receive exclusive benefits (fee discounts, special access).

- Gas Fees: Pay transaction fees on the Hyra Network.

- Access Services: Pay fees for services such as Hyra Mega AI Marketplace, HYRA AI infrastructure, auctions on Hyra Bid, etc.

- Discounts: Get discounts when using services.

- Cross-Platform Incentives: Use tokens across various integrated platforms.

Deflationary Mechanisms

- Minting tokens based on an algorithm:

HYRA tokens are minted based on:

- Ecosystem GDP: The number of tokens minted increases as the GDP grows.

- Target Price: Minting is adjusted to stabilize the market value.

- Actual Demand: Tokens are only minted when there is growth in users and businesses.

- Token circulation based on GDP and target price:

- Strong GDP growth => Increase in circulating tokens.

- Declining GDP or price lower than the target price => Decrease in circulating tokens.

- Periodic token burn of excess supply: All excess tokens from transaction fees, reserve funds, or unused rewards will be burned quarterly. This ensures the total supply decreases over time, creating scarcity.

- Reward reduction based on market price: When the price of HYRA increases, rewards for users (measured in USD) will reduce the number of HYRA tokens issued.

Governance Policy

- Voting Rights:

HYRA token holders have the right to participate in voting for important decisions, such as:

- Protocol upgrades.

- Adjusting mint and burn mechanisms.

- Allocation of reserve funds.

- Enhancing Decentralization: Decentralized governance ensures that decisions reflect the interests of the community.

Token Value Growth

- Natural Scarcity Mechanism:

The supply of HYRA is tightly controlled through minting, circulation, and token burns. - GDP Growth:

Higher GDP drives the demand for HYRA, resulting in price increases. - Token Burn:

Regular burning of excess tokens to reduce supply and increase long-term value.